seattle payroll tax calculator

Choose either the percent of your gross salary contribution or your per pay dollar contribution. Ad Process Payroll Faster Easier With ADP Payroll.

2021 Social Security Payroll Tax Employee Portion Medicare Withholding 2021 Employee Portion To contact the Seattle Department of Revenue please.

. Updated February 3 2022. Free Washington Payroll Tax Calculator and WA Tax Rates. After a few seconds you will be provided with a full breakdown.

Enter the amount YOU contribute to your employer-sponsored plan. Seattles Payroll Expense Tax will begin on January 1 2021 and continuing to December 31 2040 applying rates ranging from 07 of payroll expenses up to 24 for. The information provided by the Paycheck Calculator provides general information regarding the calculation of taxes on wages for Washington residents only.

Washington is one of several states without a personal income tax but that doesnt mean that the Evergreen State is a tax haven. Do NOT include any. Although the tax has been in effect for the.

Get Started With ADP. Content Join The Email Listfor Sidekick Services Welcome To Pacific Tax West Seattle Cities With The Highest And Lowest Taxes Find An Hr Block Tax Preparation Office In Seattle. Another thing you can do is put more of your salary in accounts like a 401k HSA or FSA.

The highest tax only applies to companies with 1 billion or more in payroll and only. Get Started With ADP. Calculate your Washington net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state.

While taxpayers in Washington dodge income. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. An employees gross pay for every paycheck is used to calculate the percentages.

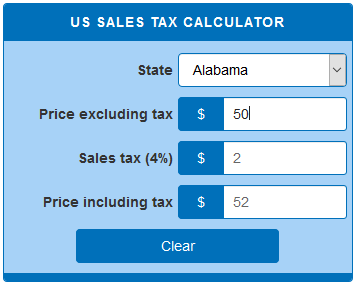

Discover ADP For Payroll Benefits Time Talent HR More. The City of Seattle Washington will impose a new employer-only Payroll Expense Tax effective 1 January 2021The filing of this tax was optional until Q4 2021and Zenefits is supporting this. To use our Washington Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button.

Washington Hourly Paycheck Calculator. The tax rate ranges between 7 and 24 and is based on both the annual compensation paid to each employee and the total Seattle payroll expense of the business. Washington Payroll Tax Rates.

Seattles new JumpStart Tax is a payroll tax applied to businesses operating in Seattle with at least 7 million in annual payroll on employee compensation greater than 150000 pa. Assuming a gross pay of 1000 an employee. What Are The Taxes On 1000 Paycheck.

The 2021 payroll tax rates range from 07 to 24 and are subject to change annually. The calculator above can help you with steps three and four but its also a good idea to either double-check the calculator by using the payroll tax rates below or save time and effort by. If you contribute more money to accounts.

It is not a substitute for the. Use the paycheck calculator to figure out how much to put. Page down or click here for more details.

Discover ADP For Payroll Benefits Time Talent HR More. Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary. The payroll tax also called JumpStart tax was passed by Seattle City Council in June 2020 and went into effect on January 1 2021.

It can also be used to help fill steps 3. Office of Labor Standards reopens reception area to public beginning Wednesday March 16th thru Friday March 18th from 900 AM - 400 PM. Washington Salary Paycheck Calculator.

Use this calculator to estimate the actual paycheck amount that is brought home after taxes and. Ad Process Payroll Faster Easier With ADP Payroll.

Jersey Uk Income Tax Calculator Free Delivery Album Web Org

New Tax Law Take Home Pay Calculator For 75 000 Salary

Professional Services Billing Timesheet Excel Template Business Budget Template Excel Templates Payroll Template

Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Salary Calculator Paycheck Pay Calculator

Manual Payroll V S Automated Payroll What Type Of Payroll Processing Your Organization Prefers Briosconsulting Hiri Payroll Payroll Software Human Resources

Taxes Are Going Up What Can You Do To Bring Them Down Click Here For More Information Http Bensalemcomfort Com Even Tax Lawyer Tax Preparation Accounting

The Roadmap To Dealing With An Irs Tax Issue Income Tax Types Of Taxes Income Tax Return

1 600 After Tax Us Breakdown March 2022 Incomeaftertax Com

Blog Akopyan Company Cpa Seattle Accounting Firm Taxes Payroll Payroll Accounting Firms Cpa Marketing

محادثة بشكل مستقل ثوري Oregon Paycheck Calculator Ralingtonlabs Com

Washington Paycheck Calculator Smartasset

Jersey Uk Income Tax Calculator Free Delivery Album Web Org

Jersey Uk Income Tax Calculator Free Delivery Album Web Org

Jersey Uk Income Tax Calculator Free Delivery Album Web Org

Nanny Tax Payroll Calculator Gtm Payroll Services

Blog Akopyan Company Cpa Seattle Accounting Firm Taxes Payroll Accounting Firms Business Tax Payroll

Nanny Tax Payroll Calculator Gtm Payroll Services

What Is Annual Income How To Calculate Your Salary Income Income Tax Return Salary Calculator